des moines iowa sales tax rate 2019

Fast Easy Tax Solutions. The average local rate is 097.

Do I Need An Iowa Sales Tax Permit Iowa Sbdc

Des Moines IA Sales Tax Rate.

. The latest sales tax rates for cities in Iowa IA state. 2020 rates included for use while preparing your income tax deduction. Look at the mortgage payment on this one with 7.

Used Cars for Sale West Des Moines IA Mercedes-Benz G 550 2019. This year the city plans to maintain its rate at 1661. There were also 6 annexation actions that affected rates for Centerton Pea Ridge Highfill.

Groceries are exempt from the Des Moines and Washington state sales taxes. This rate includes any state county city and local sales taxes. Used 2019 Mercedes-Benz G 550 for Sale in West Des Moines IA.

If only the state sales tax of 6 applies divide the gross receipts by 106 as shown in the example below. The latest sales tax rate for Des Moines IA. The Des Moines Sales Tax is collected by the merchant on all qualifying sales made within Des Moines.

Indianola IA Sales Tax Rate. Fort Dodge IA Sales Tax Rate. On Monday night the Des Moines City Council kept its promise to lower taxes in return.

Dubuque IA Sales Tax Rate. The largest increases in the past two years came in Oxnard California 15 percent the Alameda County California cities of Fremont and Oakland 1 percent and Des Moines Iowa also 1 percent. This is the total of state and county sales tax rates.

Ad Find Out Sales Tax Rates For Free. Iowa City IA. You will see a 1 increase in the following Iowa cities.

The City of Des Moines has already started spending. The city plans to cut its tax rate by 60 cents for the coming year. Total Tax Click to open a list of other matching addresses based on your search conditions.

Local Options Sales. Counties and cities can charge an additional local sales tax of up to 1 for a maximum possible combined sales tax of 7. 954 rows Lowest sales tax 45 Highest sales tax 7 Iowa Sales Tax.

An additional one-cent sales tax will start showing up Monday on shoppers receipts in Des Moines and several surrounding communities. Alleman Altoona Des Moines Pleasant Hill. Depending on local municipalities the total tax rate can be as high as 8.

What is the sales tax rate in Des Moines Iowa. Now thanks to the Local Option Sales Tax that went into effect in July of 2019 the. Iowa has state sales tax of 6 and allows local governments to collect a local option sales tax of up to 1.

The 2018 United States Supreme Court decision in South Dakota v. Des Moines Iowa The Iowa Department of Revenue has announced the 2019 interest rate individual income tax brackets and standard deduction amounts for the 2019 tax year applicable for taxes due in 2020. A retailer includes the 6 sales tax in the price of all goods and services.

127 rows Nineteen major cities now have combined rates of 9 percent or higher. In this example assume local option sales tax. The Des Moines Washington sales tax is 1000 consisting of 650 Washington state sales tax and 350 Des Moines local sales taxesThe local sales tax consists of a 350 city sales tax.

Sales Tax Rate Changes in Major Cities. This is the total of state county and city sales tax rates. Interest Rates The 2019 Department interest rate calculation is now final.

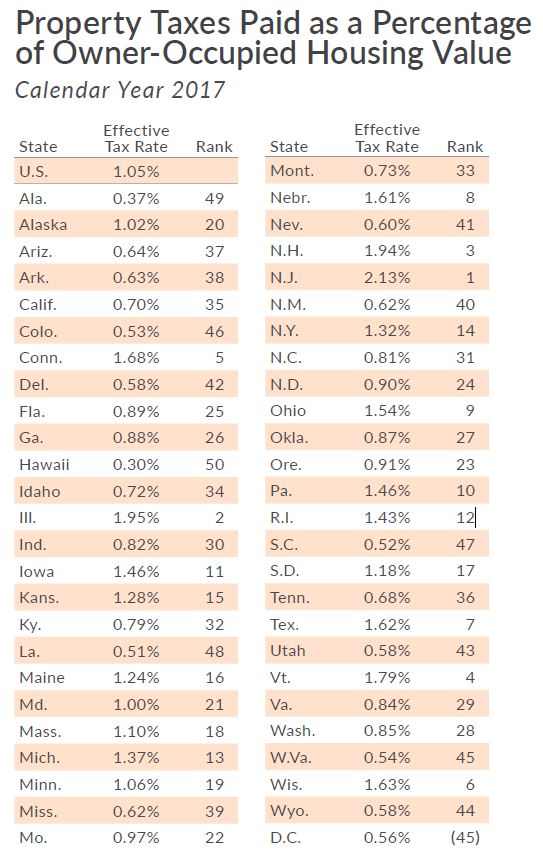

Your annual property tax bill is made up of many tax rates divided up between the Des Moines Public School District City of Des Moines Polk County Broadlawns Medical Center and a category called Other which includes DART DMACC and the State of Iowa. Iowa has 893 special sales tax jurisdictions with local sales taxes in addition to the state. The Des Moines City Council voted Monday to slash property tax rates to offset the new revenue expected by the higher sales tax.

The current total local sales tax rate in Des Moines IA is 7000. The 7 sales tax rate in Des Moines consists of 6 Iowa state sales tax and 1 Polk County sales tax. The Iowa sales tax rate is currently.

Des Moines voters approved a 1 percent local option sales tax in 2019 bringing its total sales tax rate to 7 percent. DES MOINES Iowa Last week Des Moines residents voted to raise the sales tax. Police.

2 beds 1 bath 704 sq. Average Sales Tax With Local. Earlier this year voters in Des Moines West Des Moines Altoona Pleasant Hill Windsor Heights and Alleman all approved a one-cent sales tax increase.

The Iowa state sales tax rate is currently. Twenty-five major cities saw an increase of 025 percentage points or more in their combined state and local sales tax rates over the past two years including 10 with increases in the first half of 2019. Des Moines expects to receive 37 million annually from the sales tax.

Groceries and prescription drugs are exempt from the Iowa sales tax. Des Moines which passed a penny sales tax in 2018 lowered its property tax rate by 60 cents in 2019. 2020 rates included for use while preparing your income tax deduction.

On Monday a new sales tax approved by voters takes effect. The December 2020 total local sales tax rate was. Half of the revenue.

The minimum combined 2022 sales tax rate for Des Moines County Iowa is. 705 Fremont St Des Moines IA 50316. The Des Moines County sales tax rate is.

The Iowa state sales tax rate is 6 and the average IA sales tax after local surtaxes is 678. Homes similar to 1507 E Court Ave are listed between 120K to 249K at an average of 150 per square foot. The Des Moines sales tax rate is.

You can print a 7 sales tax table here. There are a total of 832 local tax jurisdictions across the state collecting an average local tax of 0988. Road Use Tax Fund.

The minimum combined 2022 sales tax rate for Des Moines Iowa is. Rates include state county and city taxes. Des Moines IA Sales Tax Rate.

1107 Creston Ave Des Moines IA 50315 119000 MLS 650755 Want to combat the rising interest rates. If a 1 local option tax applies divide by 107. IOWA This weekend is the last chance to pay a six-cent sales tax in six central Iowa cities.

For tax rates in other cities see Iowa sales taxes by city and county. It will devote of half the money to reducing property taxes. The average combined tax rate is 697 ranking 27th in the.

Choose the address for which you want to find the tax rate. There is no applicable city tax or special tax. The Iowa IA state sales tax rate is currently 6 ranking 16th-highest in the US.

The City of Hampton has a sales tax rate of 50 starting July 1 2019. The County sales tax rate is. Tax Increment Financing Funds.

Spotting A Potential Flaw In Iowa S Property Tax System Taxpayers Association Of Central Iowa

How To File And Pay Sales Tax In Iowa Taxvalet

Iowa Tax Rates Rankings Iowa State Taxes Tax Foundation

How Do Iowa S Republican Tax Plans Compare Iowa Capital Dispatch

How To File And Pay Sales Tax In Iowa Taxvalet

How To File And Pay Sales Tax In Iowa Taxvalet

Property Taxes West Des Moines Ia

Should Iowa College Students Have To Pay Sales Taxes On Textbooks Textbook Sales Tax College Students

Notice Of Public Hearing For Proposed Property Tax Levy

File Sales Tax By County Webp Wikimedia Commons

Op Ed Cut The Rates Why Iowa Cannot Be Complacent In Lowering Income Tax Rates Iowa Thecentersquare Com

Iowa Sales Tax Rate Check Sales Tax

Iowa Sales Tax Guide And Calculator 2022 Taxjar

Iowa Lawmakers Pass Massive Tax Cut Iowa Capital Dispatch

New 1 Cent Sales Tax To Trigger Dsm Improvements

Iowa Tax Proposals Would Worsen Existing Racial Inequities Common Good Iowa

How Do Iowa S Property Taxes Compare Iowans For Tax Relief